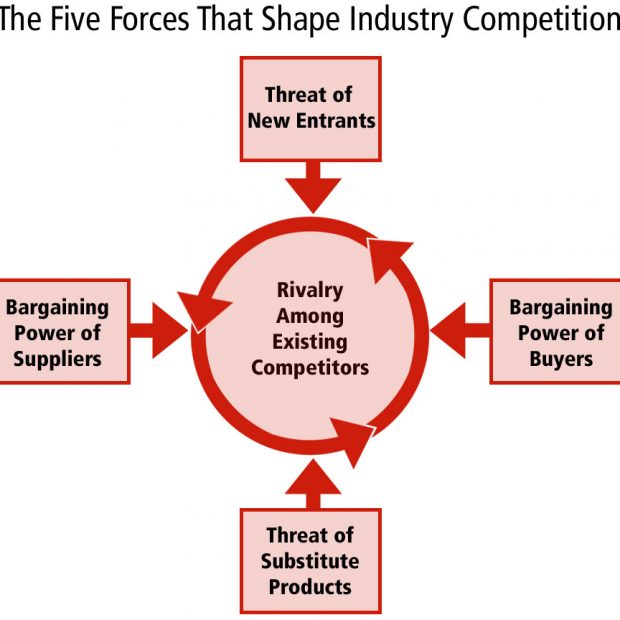

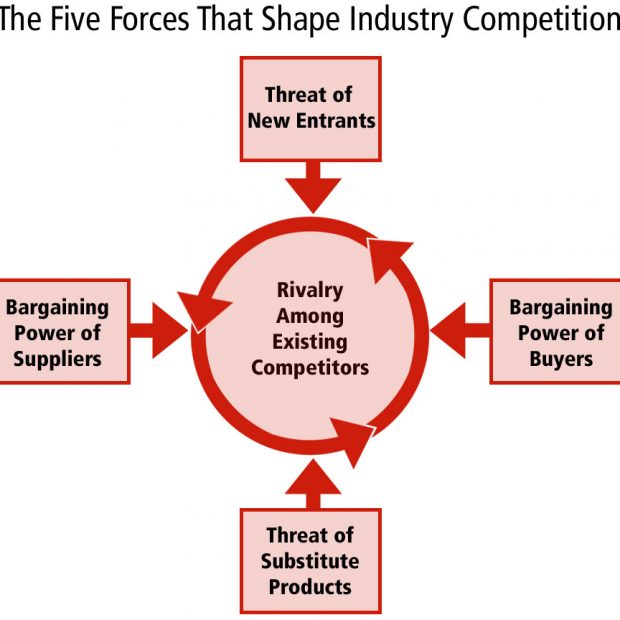

Michael E. Porter in his book “Competitive Strategy: Techniques for Analyzing Industries and Competitors” developed the model of the Five Competitive Forces in 1980. This model is an important tool for analyzing industry structure of organizations in strategic processes.

Porter’s model is based on the understanding that corporate strategies should meet opportunities and threats within the external environment of organizations. The five competitive forces that Porter has identified shape every industry as well as every market. These forces regulate the intensity of competition, the profitability as well as attractiveness of an industry.

The corporate strategy should aim to change these competitive forces in a way that improves the organization’s position. The Porters model supports the analysis of an industry’s driving forces. Management can decide how to influence or exploit particular characteristics of their industry on the basis of the information derived from the Five Forces Analysis.

The Five Competitive Forces:

- Bargaining Power of Suppliers

Supplier bargaining power is likely to be high when:

- The market is controlled by a few large suppliers and not a fragmented source of supply,

- There are no substitute for the specific input,

- The switching costs from one supplier to another are high,

- The suppliers’ customers are fragmented, so their bargaining power is low,

- The purchasing industry gains a higher profitability than the supplying industry,

- The buying industry has low entry barriers.

The association to powerful suppliers can possibly reduce strategic choices for the organization.

- Bargaining Power of Customers

The bargaining power of customers determines how much pressure can be imposed by customers on margins and volumes.

- Customers’ bargaining power appears to be high when

- They purchase large volumes making a concentration of buyers,

- The supplying industry comprises of a huge number of small operators

- The supplying industry operates with high fixed costs,

- The product is undistinguishable and can be replaced by substitutes,

- Customers have low margins and are price-sensitive,

- Customers could produce the product themselves,

- Threat of New Entrants

The threat of new entries depends on the extent to entry barriers. These are typically-

- Economies of scale (requirements of minimum size for profitable operations),

- High initial investments and fixed costs,

- Brand loyalty of customers

- Protected intellectual property like patents, licenses etc.,

- Scarcity of vital resources like qualified expert staff

- Access to raw materials is controlled by existing players,

- Threat of Substitutes

The threat of substitutes is determined by the following factors-

- Brand loyalty of customers,

- Switching costs for customers,

- Close customer relationships,

- The relative price for performance of substitutes,

- Current trends.

- Competitive Rivalry between Existing Players

Competition between existing players appears to be high when-

- There are many number of players of almost the same size,

- Players have similar sort of strategies

- There is less differentiation between players and their products, so, the price competition is high

- Low market growth rates,

- High exit barriers.